2023 turned out to be a bumper year for FDA approvals with 71 new therapeutics! This was approximately double the number of approvals in 2022. It was an interesting year, not only due to the quantity of approvals but also because of the diversity of modalities that were approved. The range of drugs included the first CRISPR-based gene therapeutic, a promising Alzheimer’s drug and multiple oligonucleotide-based drugs like siRNAs and ASOs.

Let’s cover some key trends in this and what it could mean for the future FDA approval trends.

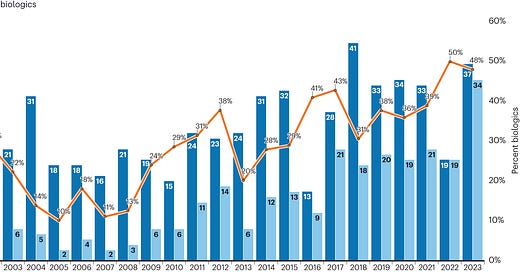

1. Rise of biologics

The overall increase in FDA approvals can be attributed to the fact that number of small molecule drug approvals has remained somewhat stable whereas the number of biologics has been gradually rising since the late 90s (orange line in Fig 1). Many have speculated about this steadfast growth of biologically derived therapeutics, some key ones being -

safer meds - biologics offer more targeted interventions and thus can be inherently safer. This is especially true for cancer and autoimmune disorders

the patent cliff - as patents on previous small molecule therapies expire, there is a push for biopharma to quickly discovery novel medicines and biology offers infinite permutations due to its complexity

better tech - with the rapid advancement in lab instruments, reagents and techniques, we understand biological systems better and can leverage this to discover therapeutics.

2. Orphans over big diseases

More than half of the approvals were for rare diseases as opposed to the biggies like Alzheimer’s, diabetes or respiratory infections. Orphan drugs for rare diseases are starting to receive more FDA approvals now due to a few reasons

upswing in incentives for biopharma companies to purse rare diseases which includes tax breaks for clinical research, availability of grants and attaining market exclusivity

regulatory support via legislation - a great example of this is passing of the Orphan Drug Act encouraging drug discovery and development for treatments that affect fewer than 200k people.

3. No love for ADCs

Antibody drug conjugates were all the rage in 2022, and often considered the perfect modality for oncology drugs. ADCs can be incredibly targeted owing to their molecular structure. They often consist of an antibody and a cytotoxic payload that can be brought directly to cancerous cells thereby avoiding off-target effects. ADCs drove multiple acquisitions and mergers in 2023 including Pfizer’s $43 billion deal to acquire Seattle Genetics and J&J’s acquisition of Ambrx Pharma.

Despite the excitement for ADCs, the 2023 list of winners did not include a single ADC, although 15 new oncology drugs did gain approval. It’s hard to explain this outcome but ADCs remain a promising option for cancer treatment and we might see an upswing in approvals in 2024. Currently there are 12 ADC candidates in phase 3 trials and another 40 in phase 2.

4. The FDA calls for better AI/ML regulation

The use of AI tools is quickly becoming prevalent in both drug discovery and development. In 2021, over 100 submissions reported the use of AI/ML methods in drug development, that span across discovery, clinical studies, post-market surveillance and manufacturing. With this in mind the FDA published a first-of-its-kind publication on March 15th, 2024 titled Artificial Intelligence & Medical Products. In this paper the FDA highlights 3 key points

need for clear regulatory guidelines around use of AI/ML components in drug development

best practices for evaluating AI use

the need for monitoring & risk management through the drug discovery and development life cycle

2024 will be an interesting year for drug discovery! To read more about FDA trends, check out these additional resources:

2023 FDA approvals: unprecedented volume at moderate value

Artificial Intelligence and Machine Learning (AI/ML) for Drug Development

Great post Vega. It's surprising how quickly ADC's appear to have come and gone from the hype cycle. There's lots of data coming so hopefully we'll see high-efficacy from what appears to be a good strategy.

I'd be interested in hearing your thoughts on where AI can impact clinical trials endpoints and whether bringing ctDNA, radiomics and other modalities into the right AI environment can shorten timelines for drug development and/or increase the impact on patients by directing therapy even better than "simple CDx"?