The Gartner report is a research document produced annually by Gartner Inc, a popular tech advisory firm. They survey executives around the world to predict industry trends and also how companies plan to spend their money each fiscal year. This year’s Gartner report on life sciences was particularly insightful and I felt it deserved a dedicated post. The data in the Gartner report was collected from over 2400 tech execs across 84 countries. The main insights can be found in a webinar here for anyone wanting to dive deeper. The 3 key highlights from the report are summarized below:

Low risk, high reward

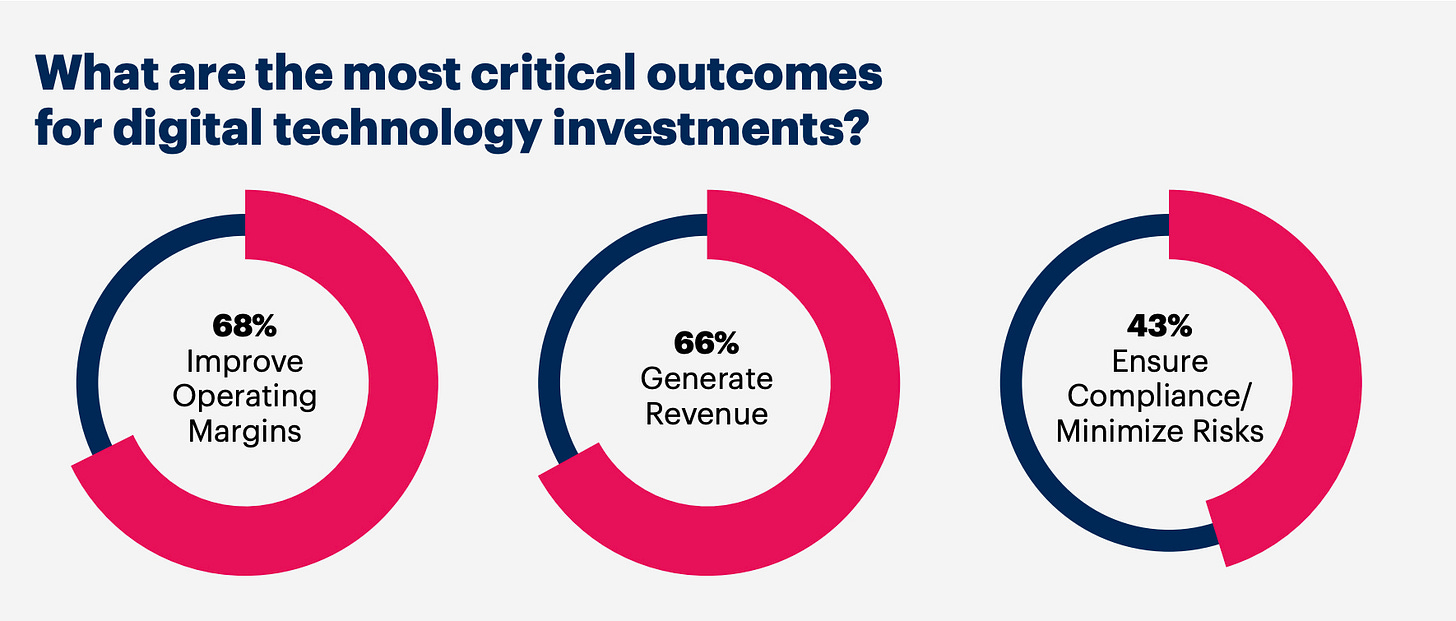

The most important outcomes of tech investments in life sciences were found to be quite practical this year — 68% execs wanting to improve margins, 66% wanting to generate revenue and 43% wanting to meet compliance requirements which is closely tied with minimizing risk. No doubt that this pragmatic wishlist is a byproduct of the economic winter that biotech and pharma companies experienced in 2023. A year that was rife with funding challenges, IPO dry spells and numerous layoffs.

AI is here to stay

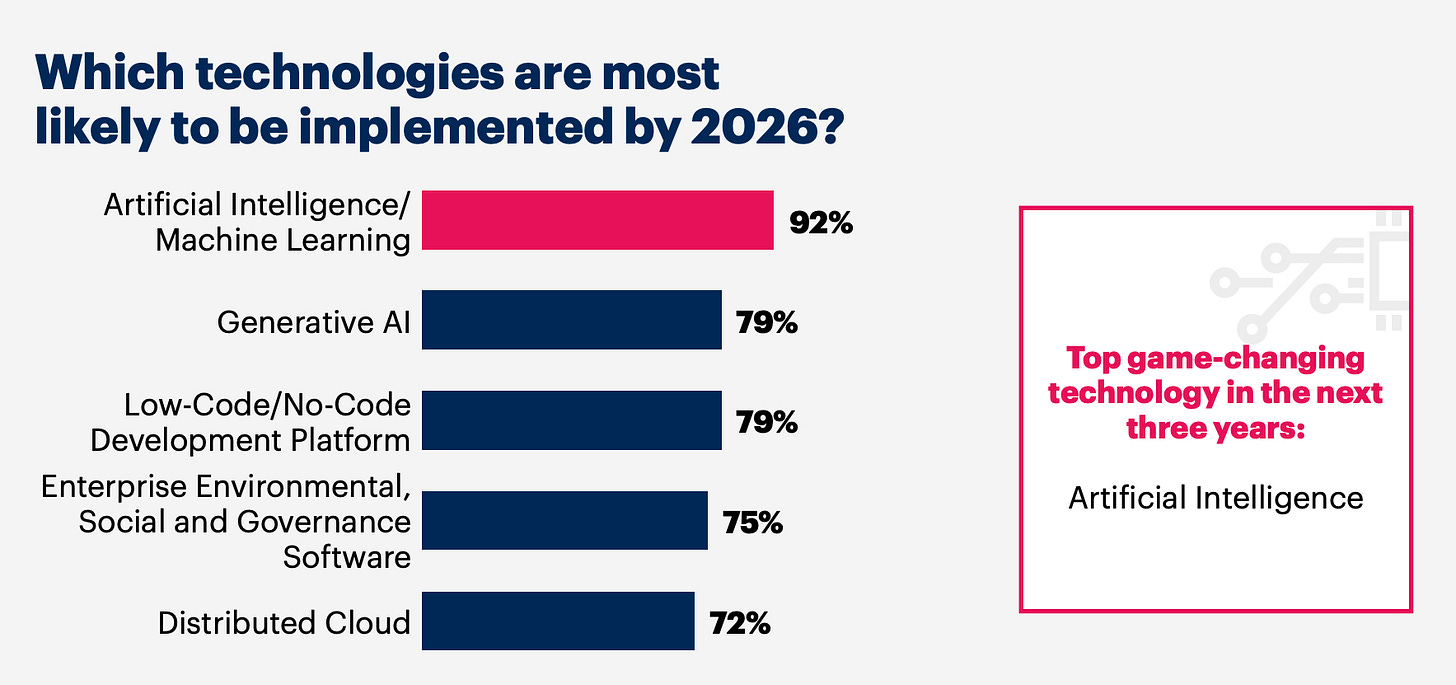

Without a doubt, the emergence of AI/ML tools has changed the life sciences landscape and what we can hope to achieve. Notably AlphaFold2 by DeepMind and later the introduction of chatGPT by OpenAI, have altered the trajectory of biotech. Since then numerous papers have been published showing proof of concept studies in how these tools can assist in drug discovery, screening, reduction of manual processes in development of drugs and numerous other applications. It is no surprise then that C-suite execs at life sciences companies are quite preoccupied with how their organization can participate in this digital gold rush. Followed by AI, a somewhat close second was the introduction of low-code/no-code development platforms. This trend could be indirectly related to the goal of reducing operational margins since most biotech employees cannot code at scale and it can be expensive to hire dedicated data teams.

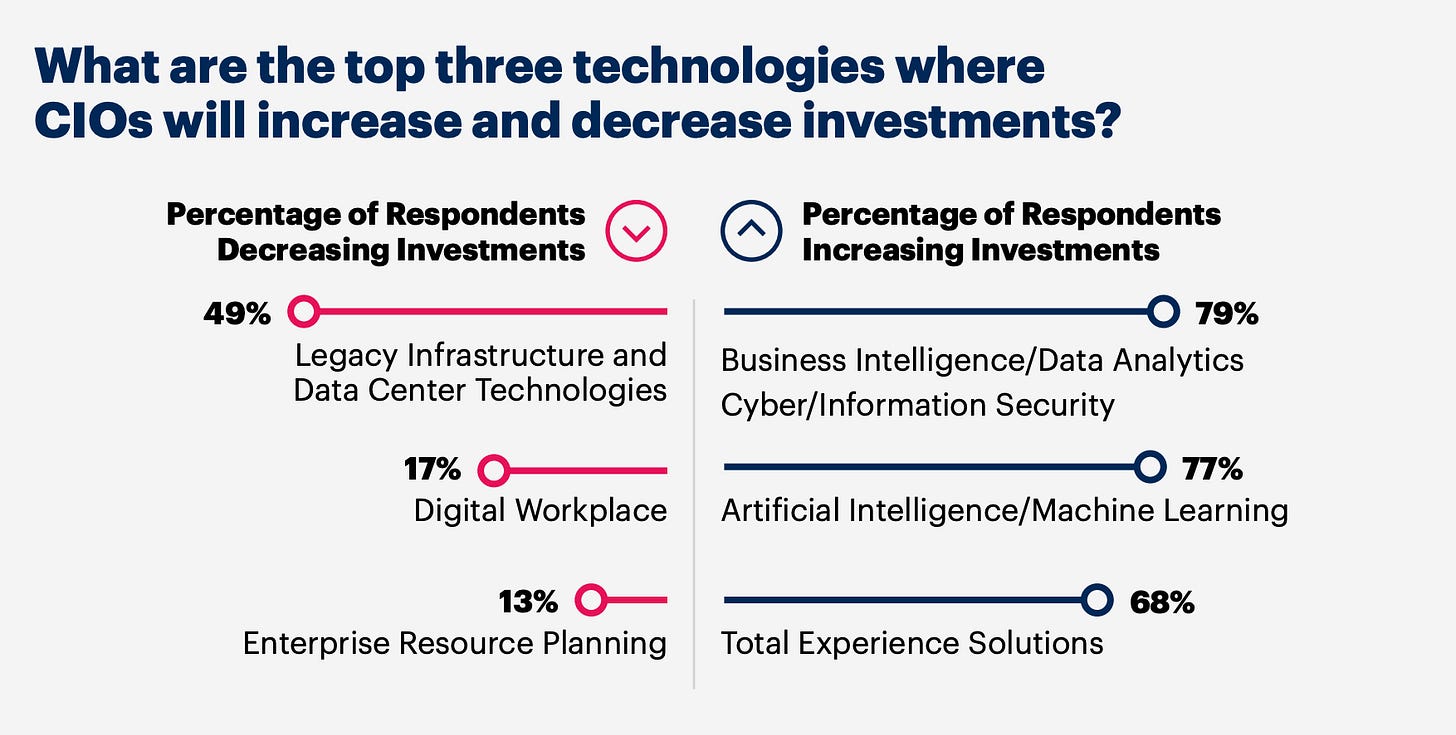

Business intelligence & solutions trump data centers

The survey shows a marked reduction in interest in traditional infra and data center technologies, which were previously considered essential in the life sciences. This shift is towards a greater focus on analytics and software solutions for managing life sciences data, moving away from using disparate, single-purpose apps. As mentioned earlier, we see noticeable excitement for the use of AI and ML applications in biotech. Perhaps an indication that we are slowly getting away from the initial skepticism.

References

Lessons from biotech downturn, Bio Pharma Dive

Computational approaches streamlining drug discovery, Nature

Artificial Intelligence in Drug Discovery and Development, Drug Discovery Today